Dalian Xiangrui Valve Manufacturing Co., Ltd.

PRODUCTS

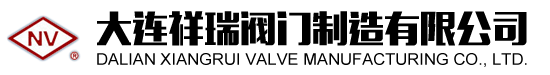

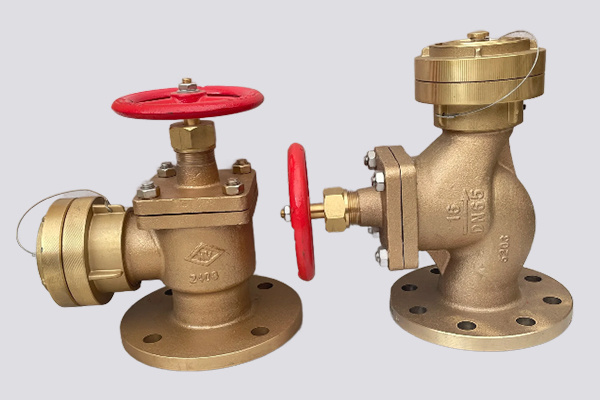

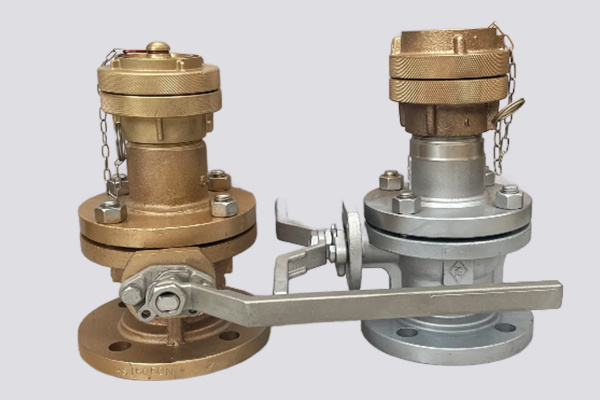

Providing customers with cost-effective High and medium pressure valves

Our main products include gate valves, globe valves, check valves, flow control valves, butterfly valves, ball valves, drain valves, and various stainless steel pipe fittings, quick connectors, etc.

ABOUT US

Dalian Xiangrui Valve Manufacturing Co., Ltd.

Dalian Xiangrui Valve Manufacturing Co., LTD.: deeply engaged in the shipbuilding field, win by quality, diversified development In Dalian, a vibrant coastal city where shipbuilding thrives, Dalian Xiangrui Valve Manufacturing Co., Ltd. has established itself as a key player in the industry——. This coastal city, known as the "Northern Pearl," boasts picturesque landscapes and convenient transportation, creating ideal conditions for business growth. As a professional manufacturer of high and medium-pressure valves, the company has gained prominence in China's northern shipbuilding market since its establishment in June 1998, emerging as a significant supplier with solid technical capabilities. The company covers an area of 6,400 square meters with a construction area of 4,700 square meters. It has 66 employees and a team of high professional title, high education and high level for valve research and manufacturing, which lays a solid foundation for technological innovation and quality control.

The company was founded in June 1998

Factory covers an area of 6400 square meters

Existing employees 165 people

50+ patent certificates

APPALICATION

Perfect service and customized solutions

Our main products include gate valves, globe valves, check valves, flow control valves, butterfly valves, ball valves, drain valves and various stainless steel pipe fittings, quick connectors, etc., with an annual output of about 350,000 sets of various valves. Involving shipping, petrochemical industry, metallurgy, electric power, light textile, pharmaceutical and coal industries.

Shipping

Metallurgy and chemical industry

Electric power

Light textile

Pharmaceutical

Coal

NEWS

News and media

2022-09-06

What are the different types of gate valves?

2021-11-15

Investment analysis of the industrial valve industry

2021-11-15

Industrial valve industry layout

2021-11-15

A fresh start in the second half

2021-11-15

Seize incremental opportunities

2021-11-15

Differentiation intensifies, where is the lifeline?

2021-11-15

2021-11-15

Guowei Valve: Various Trends in the Valve Industry

Contact us

Phone:0086-411-86734112

Phone:0086-411-86735038

Phone:0086-411-86735010

Fax: 0411-86735468

Ms. Han:0086-15309815938

Ms. Song:0086-18098804580

Email:xiangrui@dl-xiangrui.com

Address: No. 12, Xinfeng Street, Ganjingzi District, Dalian City, Liaoning Province

Leave a message